By Carl Francois, Senior Vice President, BSA and Fraud Officer, Southern First Bank, and Greg Pinn, Director, Name Screening, Babel Street

Originally published in the June-August 2023 Vol. 22 No. 3 edition of ACAMS Today, a publication of ACAMS ©️ 2023 - http://www.acams.org/

Know your customer (KYC) is a familiar topic for all banks, regardless of size. Traditionally for community banks, this was one of the easier blanks to fill in. Being local generally meant a community banker knew their customer personally or at least through easily verifiable means. There is a comfort level to an understanding with relative ease of the expected activity and background of new customers onboarded at a community bank in a traditional setting.

However, with the rapid modernization of our society, community banks have had to shift their ways of doing business. The traditional face-to-face approach with a human touch will likely always be a part of community banks, but the use of virtual means to create new banking relationships is on the rise. Younger consumers, in particular, demand the ease of access to open accounts online and conduct banking with little or no face-to-face interaction. With that in mind, community banks must figure out a way to tackle KYC to not only fulfill regulatory expectations but also attempt to keep out fraudsters and other unwanted customers.

An inefficient method to tackle the new problem is using additional human capital to review answers to account opening questions, suspect customer identification procedure information or other flags during the onboarding process. Thankfully, technology has an answer for this newfound problem: Artificial intelligence (AI). AI has found its way into so many different applications, and KYC is no exception. Let us dive into the ways it can be leveraged.

Over the last decade, AI technologies have emerged that focus on the needs of the financial industry to mitigate fraud, impersonations, money laundering and terrorist financing. While these use cases continue to grow and evolve, there are some key applications of AI with which community banks should be engaging.

In the past, these tools have often been out of the reach of community bank compliance budgets, but as these technologies have evolved, prices have dropped significantly. In addition, there have been recent enforcement actions by regulators targeting community banks.

AI for ID Verification

AI-driven identity verification platforms have become the norm for many financial institutions (FIs) during onboarding. These systems can handle significant changes to the individual being onboarded, including weight gain or loss and changes in hair or facial hair. The models are trained across millions of known true and known false image matches to identify facial structures that remain consistent with those that are variable. Research in this area has led to identification verification systems that are extremely fast and reliable and do not require human intervention, in most cases.

AI for Name Screening

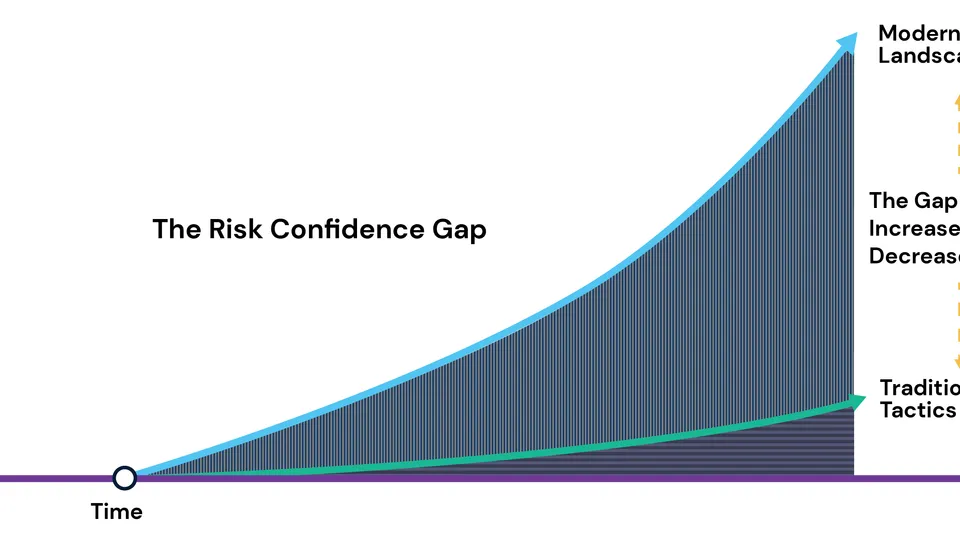

All FIs, regardless of size, must conduct regular name screening against sanctions, watchlists and politically exposed persons databases. Historically, many institutions have completed this screening using rudimentary exact, partial and phonetic matching. This limits the workload significantly but opens the FI to significant risk exposure due to the likelihood of missing a result. Other solutions that only add elements such as nicknames decrease risk exposure but add to the team workload and, therefore, compliance costs.

Because of these challenges, AI is essential for name screening. Through trained AI and natural language processing, sophisticated name-screening engines go well beyond fuzzy logic and nickname databases. This includes features such as gender identification (matching based on same-gender results to ensure John and Joan do not match although they are phonetically similar) and name truncation (providing matches where bad data is entered into the system, such as matching against Blankensh when Blankenship is the proper name).

AI for Adverse Media

Legislation1 around specific customer due diligence and anti-money laundering (AML) requirements have always been vague, as there is no one-size-fits-all approach to risk mitigation that can properly balance risk and resources. The U.S. government uses a risk-based approach to guide FIs to policies that meet the size, scope and focus of their business. In a 2020 guidance,2 the Financial Crimes Enforcement Network (FinCEN) notes that institutions may not need to conduct media searches or screen news articles if they fall below their risk threshold. The bar for what is required, however, keeps rising.

As community banks expand their customer base, their risk profile grows; thus, their need to conduct adverse media searches grows. Historically, many community banks have used Google News (or a similar, free news service) to conduct these investigations. The rationale has been that these services are free and therefore limit the total financial cost of adverse media due diligence. Unfortunately, tools like this are not built to suit this process and result in a huge workload for analysts who need to process dozens or hundreds of articles to reach an accurate determination.

AI for adverse media solves these challenges by conducting much of the initial review for analysts:

- Ingestion of up-to-date global media data

- Detection of exact duplications and combination of thematic articles

- Extraction of individual and business names

- Extraction of key biographical details such as locations and age/date of birth

- Identification of risk, aligned to Financial Action Task Force-designated predicate offenses

- Identification of perpetrator of risk

These tasks require sophisticated AI systems built on heavily annotated and tagged data. Several AML vendors have built products for this purpose, greatly reducing the workload of analysts while expanding the scope of risks covered as compared to human-curated databases.

AI for Ultimate Beneficial Ownership (UBO)

The difficulty in identifying complete corporate hierarchies, including beneficial ownership, varies greatly based on the jurisdiction of the target company. Many European jurisdictions provide direct access to UBO registers, and the U.S. is moving toward a nationwide register3 in 2024 to align with FinCEN reporting requirements4 for UBO.

While these registries will ease compliance with UBO requirements (as defined in the National Defense Authorization Act of 2021),5 FIs, including community banks, will still be required to do additional UBO research. This research must be conducted on companies that fall outside of these registries, including non-U.S. or European Union companies or companies that fall into the 24 categories6 of U.S.-excepted organizations.

Uncovering these beneficial owners, including those in high-risk jurisdictions7 such as Venezuela, Iran, Syria and Russia, can be very difficult as reliable documentation can be hard to locate and cross-reference. This is where AI plays a key role in uncovering UBO and corporate structures.

Complex data extraction of images and PDFs, combined with reputable news and blog sites, wikis, and user-generated and published content, provide a complex view of corporate details that cannot reasonably be analyzed by humans. This is where AI has proven as a reliable solution to this problem. Through analysis of large data sets, these AI systems look for patterns to uncover and confirm ownership hierarchies.

Conclusion

Ultimately, with all of the various ways AI can benefit community banks, awareness of its capabilities is a starting point. Then each institution must determine, based on its own risk profile, what areas AI can fill needed gaps. With the cost of the technology coming down, it is ever more attainable for smaller institutions to take advantage of AI. Finally, finding the right partner for your institution is paramount to help you achieve your goals of streamlining processes using this resourceful technology.

Endnotes

- “31 CFR § 1020.210 - Anti-money laundering program requirements for banks,” Cornell Law School, September 15, 2020, https://www.law.cornell.edu/cfr/text/31/1020.210

- “Frequently Asked Questions Regarding Customer Due Diligence (CDD) Requirements for Covered Financial Institutions,” Financial Crimes Enforcement Network, August 3, 2020, https://www.fincen.gov/sites/default/files/2020-08/FinCEN_Guidance_CDD_508_FINAL.pdf

- “Beneficial Ownership Information Access and Safeguards, and Use of FinCEN Identifiers for Entities,” Federal Register, December 16, 2022, https://www.federalregister.gov/documents/2022/12/16/2022-27031/beneficial-ownership-information-access-and-safeguards-and-use-of-fincen-identifiers-for-entities

- “Beneficial Ownership Information Reporting Requirements,” Federal Register, September 20, 2022, https://www.federalregister.gov/documents/2022/09/30/2022-21020/beneficial-ownership-information-reporting-requirements

- “William M. (Mac) Thornberry National Defense Authorization Act for Fiscal Year 2021,” GovInfo, January 21, 2020, https://www.govinfo.gov/content/pkg/PLAW-116publ283/html/PLAW-116publ283.htm

- “Beneficial Ownership Information Reporting Requirements,” Federal Register, April 5, 2021, https://www.federalregister.gov/documents/2021/04/05/2021-06922/beneficial-ownership-information-reporting-requirements#footnote-32-p17560

- “Corruption Perceptions Index,” Transparency International, 2022, https://www.transparency.org/en/cpi/2022